Uncovering the Australian and New Zealand Food Delivery Landscape

A Data-driven Approach

From the Ancient Roman Thermopolium to online food orders, food delivery has come a long way. With great convenience, simplicity and limitless reach, it comes to the pinnacle of food delivery services in the 21st century. As one of the fastest-growing markets worldwide, revenue in the online food delivery market is projected to reach US$0.91 trillion in 2023 [1]. Following the analysis of the European Food Delivery Race and Southeast Asian Food Delivery Race, we are expanding the series into a new scope. This article combines data acquired from Dashmote’s Data Analytics SaaS platform and extensive industry research, to report on the trends, market shares, and growths of key food delivery players in the 2 major Oceanian markets: Australia and New Zealand.

Oceanian food delivery market at a glance

Australia is one of the most mature delivery markets globally [2], and it is experiencing rapid growth, driven by a surge in customer demand for convenient and flexible food options. The US$11.84 billion food delivery market in Australia and Oceania is expected to show an annual growth rate of 10.70% from 2023-2027 [3].

Food delivery services in Australia and New Zealand have been dominated by the gig economy, a new type of flexible work that not only allows workers to set their work schedule but also allows them to change it in real-time [4]. The German-founded company, Foodora, was one of the first gig economy food delivery companies to launch in Australia. However, in August 2018, Foodora announced its exit from the Australian market, leaving a gap in the market for other companies to fill [1].

Today, food delivery, which may have operated as an alternative during the pandemic, has become embedded in the Oceanian lifestyle. Big multinational corporations like Deliveroo, Uber Eats, and Menulog are dominating the market in Oceania, with services that are likely to proliferate further. By leveraging Dashmote’s Data Analytics SaaS platform, the following section will elaborate on the key players in the race of Oceanian food delivery in 2022.

Key players in the food delivery market in AU and NZ

According to Dashmote’s data, the food delivery market in Australia is more than 10 times bigger than NZ in terms of digital storefront (DSF) base. To make it more comparable - we divide the total number of DSFs on food delivery platforms in Australia (144K) and NZ (13K) by their population. We could see that there are around 554 DSFs per 100,000 population in Australia, whereas in NZ there are 245 DSFs per 100,000 population.

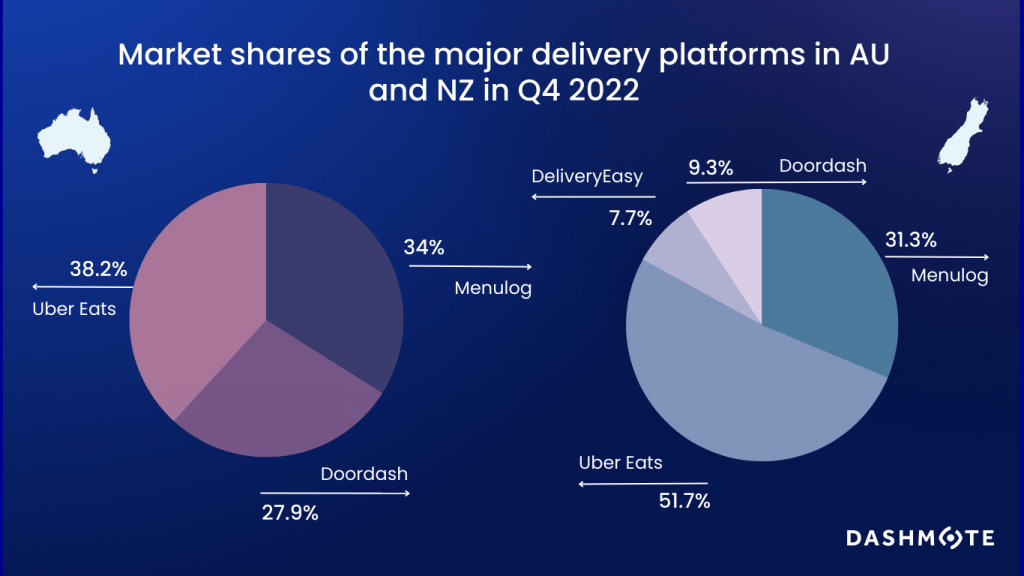

Uber Eats has by far the largest food delivery market share in Australia (38.2%), with more than 55K DSFs across its platform in Q4 2022. The second largest platform is Menulog. It had a market share of 34% and a DSF base of 49K in Q4 2022. Deliveroo used to have a market share of 17.1% in Q3 2022. However, it pulled out of the Australian market in November 2022, citing a tough business environment and stiff competition that exists in Australia. In fact, although the Australian food delivery market has experienced significant growth in recent years, especially due to the COVID-19 pandemic and subsequent lockdowns, Deliveroo accumulated losses of more than $120 million last year.

In New Zealand, Uber Eats is the biggest player, which dominates more than half of the food delivery market. It has a market share of 51.7% in Q4 2022. This is followed by Menulog, with a 31.3% market share. The largest on-demand local commerce platform in the United States, Doordash, was launched in NZ in May 2022, bringing more competition to the local online ordering space. By the end of 2022, Doordash already gained a 9.3% food delivery market share in New Zealand, according to Dashmote’s data.

The fastest growing platforms in 2022

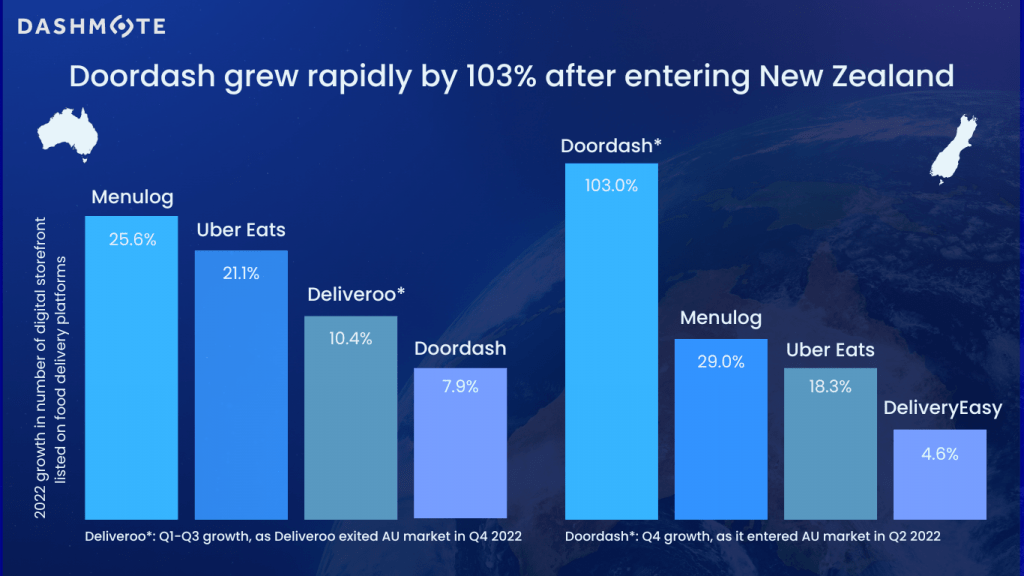

According to Dashmote’s data, all platforms saw positive year-to-date growth in DSFs listings, except for Deliveroo, which left the Australian market in Q4 2022. In Australia, Menulog saw the largest growth of 25.6% in 2022. This is followed closely by Uber Eats, with a 21.1% growth. Doordash, which expanded its business to New Zealand, saw a minimum growth of 7.9% in 2022.

Although Doordash‘s expansion in Australia is lagging, it is taking up New Zealand food delivery space in a storm. According to our data, Doordash saw a staggering 103% quarter-over-quarter growth in Q4, leaving Menulog (+29%) and Uber Eats (+18.3%) far behind. DeliveryEasy, a New Zealand-based delivery service, saw a minimum year-to-date growth of 4.6%. The entry of Doordash brought more complexity to the New Zealand food delivery market. With 4 active players each commanding certain large urban markets and forming an entire ecosystem in the food delivery space in New Zealand.

Who are we?

Dashmote is the leading big data and AI analytics company in the food & beverage industry. We help F&B enterprises by empowering leaders and analysts to track and analyse publicly available data to contribute to making strategic decisions for your brand. Are you interested in retrieving market insights across food delivery and F&B?

→ Please contact sales@dashmote.com.