Subway vs McDonald's: Who do you think will win Food Delivery in Australia?

The quick-service restaurant (QSR) industry has been witnessing a revolutionary trend as consumers reduce dining in and utilise delivery options. Something that was initially popularised due to the pandemic seems to be sticking around. The global restaurant operators are also taking notice of it. In McDonald’s third-quarter earnings report, CEO Chris Kempczinski emphasised a digital momentum. He mentioned that digital sales now represent over one-third of systemwide sales in McDonald’s top six markets. This signifies the importance for QSRs to partner with delivery platforms to open up additional channels for consumers to access their ‘Happy Meal’ or ‘Whopper’.

As one of the top six markets of McDonald’s according to FoodService[1], Australia is also one of the biggest countries for food delivery with the most number of digital storefronts (DSFs*). In Australia, the revenue in the Online Food Delivery segment is expected to show an annual growth rate (CAGR 2022-2027) of 8.12%, resulting in a projected market volume of US$3.17bn by 2027[2]. In this article, we investigate the top QSRs in the Australian food delivery market. We aim to provide insights into the market shares and growths of these key players.

DSFs*: A DSF refers to the digital representation of a business on a food delivery platform.

Top quick-service restaurants on food delivery in Australia

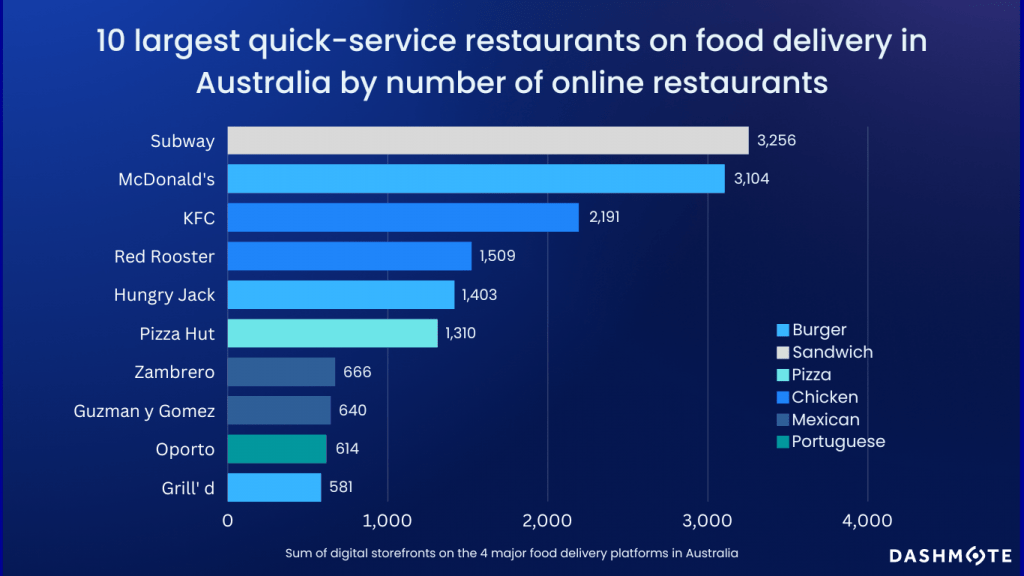

Our data reveals the top 10 QSRs on food delivery in Australia. Subway and McDonald’s are competing to be the biggest QSR — both brands have around 3K DSFs on Australian food delivery across Uber Eats, Just Eat, DoorDash, and Deliveroo. KFC, Red Rooster, and Hungry Jacks - an Australian fast food franchise of the Burger King Corporation, make up the rest of the top five brands. It’s important to note that McDonald’s, KFC, and Pizza Hut all have self-managed delivery infrastructure parallel to their presence across food delivery platforms, which to some extent might affect their strategies on these external platforms. As you can see, Domino’s is not in the top 10 since they are delivering 100% via their own infrastructure.

The top 10 QSRs on food delivery in Australia have diverse cuisine types, bringing a variety of options to Australian consumers. Burger is the most common cuisine type within the top 10 QSRs, followed by chicken and Mexican food. While the pandemic boosted the food delivery industry, the breadth of offerings becomes a key consideration that determines which brands win or lose as the industry develops. Pizza Hut’s digital co-brand WingStreet recently partnered with DoorDash in July 2022 to bring greater availability in offerings to its Australian consumers. This extension of the menu contributes to the success of the brand in Australia.

These days, it’s important for QSRs to treat off-premises guests with the same level of care and attention as those who dine inside. Achieving No.1 in YouGov’s 2022 Dining and QSR rankings in Australia[3], Subway is updating all their consumer-facing channels to enhance its feedback mechanism[4]. Among similar lines, McDonald’s has been investing in mobile-driven marketing solutions to drive digital engagement among off-premises consumers. Pizza Hut also invests largely in technology and food delivery, which has enabled the company to reduce its delivery time by 40%. By teaming up with food delivery platforms, QSRs can provide greater availability and care for their off-premises consumers.

Growth of quick-service restaurants on food delivery in 2022

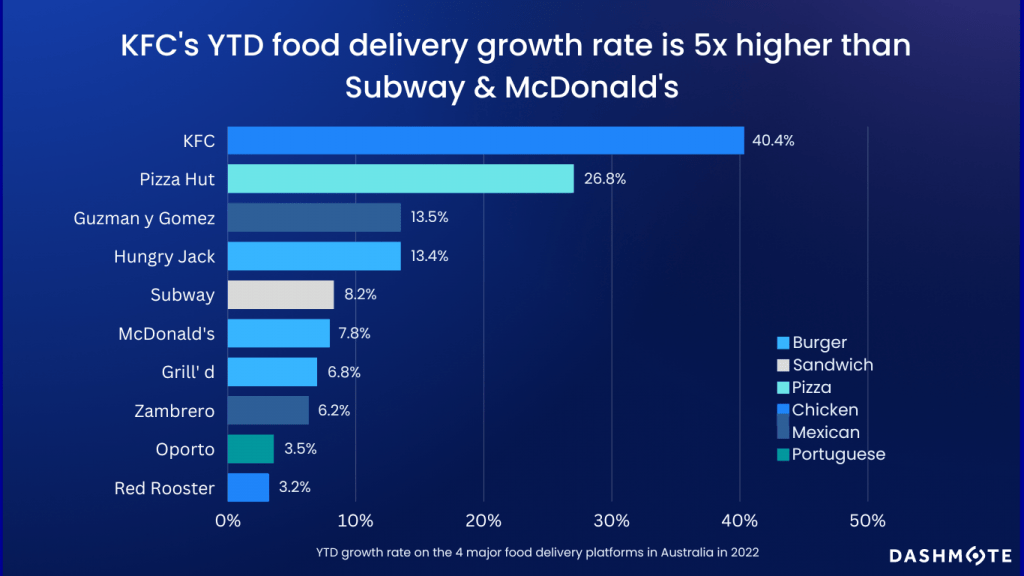

Our data shows that there is rapid growth for most of the top 10 QSRs on food delivery in Australia in 2022. Due to a new partnership with Uber Eats in Q2 2022, the growth rate of KFC increased the most by 40.4%, which was around five times more than McDonald’s and Subway. Moreover, Pizza Hut also had a distinct increase in the number of DSFs on food delivery due to the push of WingStreet on the DoorDash platform. Overall, the remarkably stable growth of top QSR brands across three quarters in 2022 implies the dominance of fast-food franchise outlets on delivery platforms in Australia.

Today’s QSR is a multi-faceted and complicated business due to the change in consumer habits during the pandemic. Even after the lift of most COVID-19 restrictions, the popularity of ordering food online hasn’t stopped. More than just recovering from the pandemic crisis, QSR businesses, such as Subway and McDonald’s, are growing significantly again, especially in digital sales. To win the food delivery game, QSRs need to strategically partner with major platforms to increase the accessibility of the outlets in the integrated digital ecosystems. It’s essential for restaurants to keep tracking the performances of their own brands as well as their competitors to determine the next strategy.

Dashmote is the leading big data and AI analytics company in the food & beverage industry. We help F&B enterprises by empowering them to track and analyse publicly available data to making strategic decisions. Are you interested in retrieving market insights across food delivery and F&B?

→ Please contact sales@dashmote.com.