September 27, 2024

The chips market in 2022 set a new growth story on food delivery

Chips, also referred to as crisps in the UK, are thin snacks that are seasoned and fried till crisp. Invented in 1853 in New York, chips today are one of the most extensively consumed snacks across the world. This high demand are still rising continuously and significantly. Statistics show that the global Chips Market is likely to grow with a CAGR of 3.92% from 2020-2028, and is projected to reach US$ 43.8 Billion by 2028 [1].

As chips became a regular part of many consumers’ diets, manufacturers and marketers are seeking to expand their channels digitally to reach a wider consumer base. Although the Supermarket category currently still holds the most significant shares in sales and distributions of chips, the Online Retailing category is expected to be the fastest expanding segment over time [2]. This growth is due to the greater availability of a wide selection of flavours, faster accessibility, and the easy cost comparison of different chip products across the platform.

Food delivery platforms nowadays are an increasingly common way for consumers to purchase groceries, including chips. In this article, we generate food delivery insights in 2022 which reflect the digital trends and opportunities shaping the chips industry. By leveraging Dashmote’s Data Analytics SaaS platform, we analysed the penetration rates and growths of top chip brands and manufacturers on food delivery platforms in the US and UK.

Chips market in the US food delivery industry

Our data show that the most listed chip brand on US food delivery in 2022 was Doritos. It has a 9.9% penetration rate among all the Digital Storefronts (DSFs) on food delivery. Lay’s (8.9%) and Cheetos (7.0%) are following in the ranking. PepsiCo, Synder’s-Lance, and Kellogg’s are the key players in the market. Remarkably, PepsiCo manufactures 8 out of 10 top chip brands on US food delivery. This indicates its dominant position in the digital space of chips.

PepsiCo was established in the US in 1965. Today, it is present in nearly 200 countries. It focuses on launching new products in order to gain maximum market share [3]. In January 2021, PepsiCo launched its Doritos Flamin Hot Cool Ranch flavoured potato chips. These innovative flavours certainly contributed to brand visibility across the globe. Kellogg’s is another major player in the potato chip industry. It focuses on business model transformation to enhance performance and increase long-term shareowner value. In fact, in 2022 Kellogg’s planned to separate into three independent companies [4]. This transformation helped the company to enhance its production capacity and resources toward its leading snack brands, such as Pringles.

The existing players strive on improving their market shares in the food delivery industry. In the top 10 chip brands, Tostitos grew the most in digital storefront listings by 22% in Q4 2022. This is followed by Fritos with a 20% growth and Ruffles with a 17% growth. All 3 brands are owned by PepsiCo, representing the strong profitability of its iconic brands on food delivery. Moreover, 9 out of the top 10 brands saw a positive growth between 7% to 22% in Q4, 2022. This indicates a flourishing digital market space for chips on US food delivery.

Crisps market in the UK food delivery industry

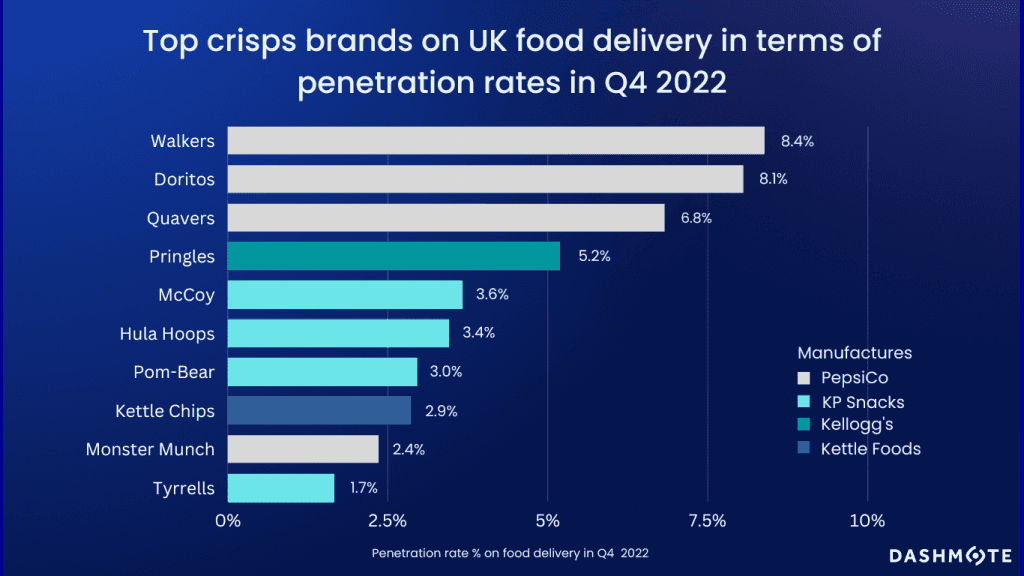

In the UK, Walkers, Doritos, and Quavers are the top 3 crisp brands on food delivery in terms of DSFs listings. They are all manufactured by PepsiCo, with a penetration rate between 6.8% to 8.4% among all DSFs in Q4, 2022. Unlike the domination of PepsiCo in the top 10 chip brands on US food delivery, in the UK, the British company KP Snacks is quickly catching up with 4 of its leading brands. It is clear from our data that, after investing $7.5 million into opening a new production site for its Pom-Bear and Hula Hoops Puft brands in 2019 [5], these brands are showing strong growth momentum and profitability in the digital space.

Let’s now talk about growth. According to Dashmote’s data, Pom-Bear grew the most by a staggering 133% on food delivery in terms of DSFs listings in Q4 2022. Tyrrells (55%), a premium brand also from KP Snacks, and Monster Munch (35%) from PepsiCo are following. All top 10 brands saw positive growth in Q4 2022, which indicates that there are significant opportunities in the food delivery industry for crisp brands’ long-term category prospects and further expansions.

For chips brands, food delivery serves as an additional channel to reach a wider consumer base. Food delivery can add chips as a convenient food option for a number of reasons. Firstly, chips are easy to transport with their own packages. Secondly, it always stays crispy, compared to french fries that lose crispness during transportation. Thirdly, restaurants can ass chips as a combo deal to provide variety to the meals and add great margin to the restaurants. Therefore, we anticipate supplies of chips to rise further on food delivery across the globe.

Mission at Dashmote

At Dashmote, we’re shaping the next generation of prospecting with AI. We leverage AI to provide companies with the most relevant and high-potential sales leads. Our technology delivers precise and personalized scoring for each location, empowering sales teams to target the best opportunities. We aim to reduce wasted time and resources, ultimately unlocking better conversion and business outcomes. Target the best leads, every single time.

Ready to Get Started?

Interested in how we can help you achieve similar results? Get in touch with us to discuss your specific needs and set up a free trial to see Dashmote in action.