September 27, 2024

Mapping the Landscape of Canned Beverages on Food Delivery in 2023

The concept of preserving food in containers dates back centuries. Ancient civilizations used various methods such as smoking, drying, and fermenting to extend the shelf life of food. Later on, in 1810, the Englishman Peter Durand patented the idea of preserving food in tinplate cans. This marked the beginning of the canning industry.

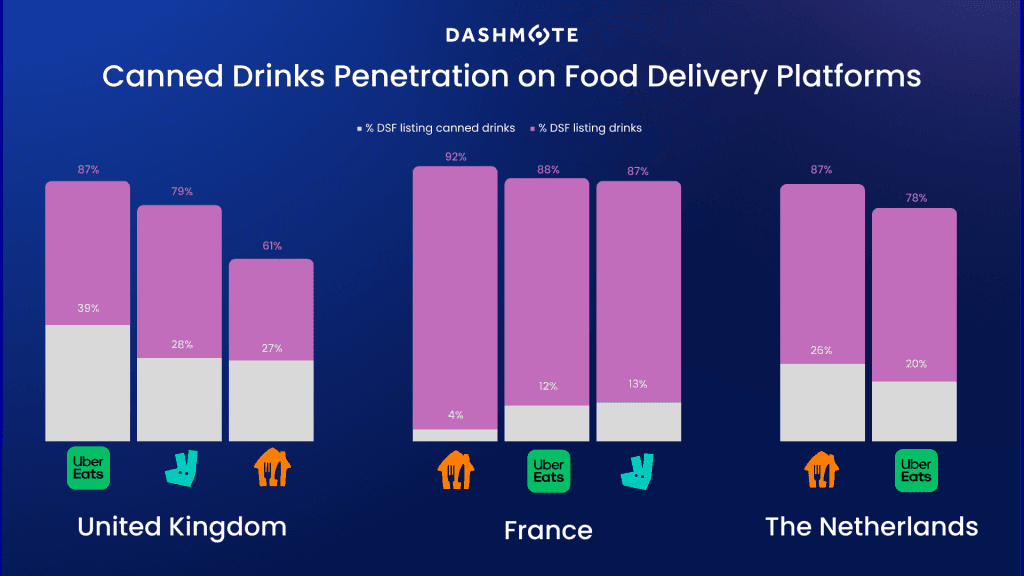

We conducted comprehensive research across the dynamic landscapes of the Netherlands, the United Kingdom, and France, focusing on the leading platforms JustEat Takeaway.com, Uber Eats, and Deliveroo. While focusing on canned drinks is crucial, understanding the total landscape of DSFs listing drinks provides a comprehensive view.

Canned Drinks Deep Dive in the United Kingdom

Analyzing the year-end landscape, Uber Eats takes the lead in the UK with 39% of DSFs listing canned drinks, closely followed by Deliveroo with 28% and JustEat Takeaway.com with almost 27% of DSFs listing canned drinks. In the UK, Uber Eats has the highest number of DSFs listing drinks (86%), showcasing the popularity of beverages on food delivery. Given the existing high popularity of drinks on UK food delivery platforms, suppliers should explore opportunities beyond canned drinks to further cater to their consumers.

Canned Drinks Deep Dive in France

Deliveroo dominates with a substantial 13% of DSFs, prominently featuring canned drinks in the French food delivery landscape. Parallelly, Uber Eats secures a notable 12% of DSFs, while JustEat Takeaway.com commands nearly 4%. Noteworthy is JustEat Takeaway.com's overall leadership, boasting an impressive 92% of DSFs featuring drinks, demonstrating a nuanced approach with only 4% dedicated to canned options. This gap in the market suggests a potential area for suppliers to capitalize on and explore within the extensive drinks category.

Canned Drinks Deep Dive in the Netherlands

Delving into the dynamics of the Netherlands' year-end food delivery landscape, JustEat Takeaway.com emerges as a formidable leader, commanding an impressive 26% of DSFs, while Uber Eats secures a noteworthy 20% share. It’s worth mentioning that Deliveroo exited the Netherlands in November 2022, hence the platform doesn’t form part of this analysis. Between Uber Eats and JustEat Takeaway.com, the latter has the highest number of DSFs listing drinks (87%). Given the intense competition between these two platforms, strategically emphasizing the beverage listings could offer both suppliers and food delivery platforms a valuable edge in meeting the diverse preferences of consumers.

Key Takeaways

It is worth noting that in France and the Netherlands, JustEat Takeaway.com has a stronger presence than in the UK, which reflects on the variations between different markets and platform sizes, and the need to have reliable data to base decisions on.

Drink penetration is a lot higher in France and the Netherlands compared to the UK, although there are differences per platform. In the UK, across all 3 platforms, the average drink penetration is almost 78%, whereas in France and the Netherlands, this number rises to a staggering 89% and 83% respectively.

Can penetration is notably higher in the UK than in France, especially on JustEat Takeaway.com, where only 4% of DSFs are selling canned drinks.

Packaging Clarity and Growth Initiatives

To navigate the intricate landscape of the food delivery industry successfully, it's important for canned drink suppliers to prioritize packaging clarity. Clear and standardized information on packaging not only boosts consumer confidence but also enhances the appeal of canned beverages. In the fiercely competitive market, aligning with platform preferences in each country becomes crucial, requiring suppliers to emphasize unique selling points and communicate transparent packaging information effectively. Collaborative marketing endeavors, whether through partnerships with leading food delivery platforms or direct engagement with merchants, have the potential to elevate visibility and attract a larger customer base. Furthermore, in this data-driven era, suppliers can revolutionize their growth strategies by leveraging Dashmote's expertise. Dashmote’s data unlocks visibility on the FSA landscape, providing actionable insights which can help teams make more informed decisions.

Mission at Dashmote

At Dashmote, we’re shaping the next generation of prospecting with AI. We leverage AI to provide companies with the most relevant and high-potential sales leads. Our technology delivers precise and personalized scoring for each location, empowering sales teams to target the best opportunities. We aim to reduce wasted time and resources, ultimately unlocking better conversion and business outcomes. Target the best leads, every single time.

Ready to Get Started?

Interested in how we can help you achieve similar results? Get in touch with us to discuss your specific needs and set up a free trial to see Dashmote in action.